|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

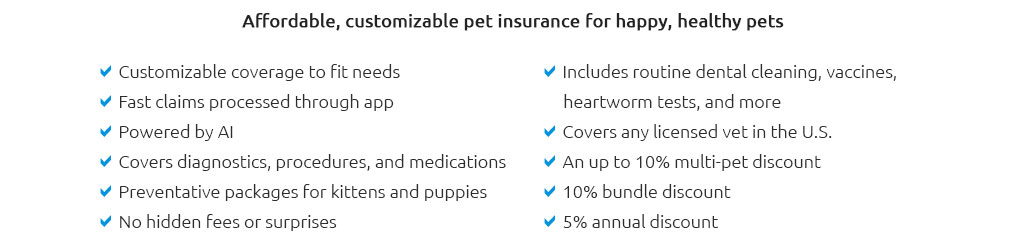

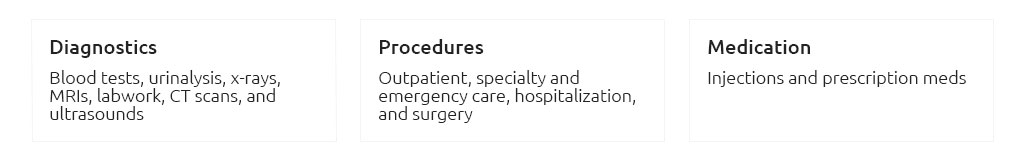

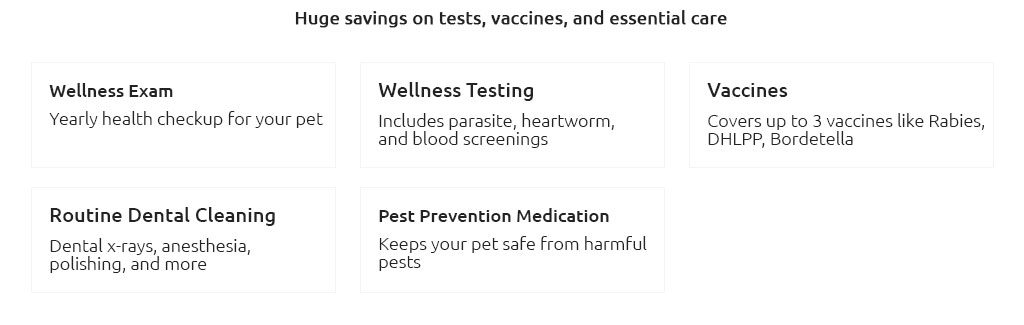

Exploring the Benefits of Cheaper Pet InsuranceAs pet ownership continues to rise, so does the necessity for pet insurance, a safeguard that once seemed like a luxury but now emerges as a practical component of responsible pet care. The market for pet insurance has expanded, offering a range of options that vary widely in terms of cost and coverage, prompting many pet owners to seek out cheaper alternatives that do not compromise on essential benefits. This article delves into the world of affordable pet insurance, highlighting its benefits and potential drawbacks, and offering insights into making the most informed choice. Pet insurance, at its core, is designed to alleviate the financial burden associated with unexpected veterinary expenses. The reality of veterinary care is that it can be expensive, particularly in emergencies or for chronic conditions. For many, the cost of insurance can be a deterrent, but exploring cheaper options can open doors to financial security without breaking the bank. These less expensive plans often focus on covering major medical expenses, while excluding some of the routine care costs, which many pet owners are willing to pay out-of-pocket in exchange for lower premiums. One of the key advantages of opting for a more economical insurance plan is the ability to tailor coverage to suit both budgetary constraints and the specific needs of your pet. While comprehensive plans cover a wide array of potential ailments and treatments, they also come with higher premiums. Cheaper insurance plans typically offer a more streamlined approach, focusing on critical coverage that aligns with the most common and costly health issues faced by pets. This ensures that pet owners are not overpaying for unnecessary coverage, yet remain protected against major financial setbacks. However, it's crucial for pet owners to be aware of the limitations that come with cheaper insurance plans. These plans may have higher deductibles, co-pays, or lower annual caps on payouts. It's important to read the fine print and understand what is included and what is not, as this can vary significantly between providers. A plan that appears affordable on the surface may end up being costly if it doesn't adequately cover the specific risks associated with your pet's breed or age. In selecting a cost-effective pet insurance plan, pet owners should consider several factors. Research and comparison are critical; utilizing online tools and resources can aid in assessing the value of different policies. Additionally, consulting with a veterinarian can provide insights into the most common health issues for specific breeds, helping tailor coverage to those risks. It's also worth considering the reputation and reliability of the insurance provider, ensuring that claims will be handled smoothly and efficiently when needed. In conclusion, while the allure of cheaper pet insurance is evident, it requires a careful balance between affordability and adequate coverage. Pet owners should approach the decision with diligence, ensuring that the chosen plan provides sufficient protection against significant health-related expenses without unnecessary financial strain. By doing so, they ensure that their beloved companions receive the care they deserve, while also maintaining a stable financial outlook. https://www.progressive.com/pet-insurance/

Pets Best offers an affordable, fixed-price pet insurance plan for broken bones, bite wounds, accidental swallowing of foreign objects, and other common ... https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ... https://www.phidirect.com/

Say hello to lower premiums with PHI Direct. No inflated prices. Just high value pet insurance. That won't leave your finances bent out of shape.

|